- The Australian stock market experiences an $115 billion drop.

- The Australian dollar fell below 60 US cents, similar to what happened during the early stages of the COVID-19 pandemic.

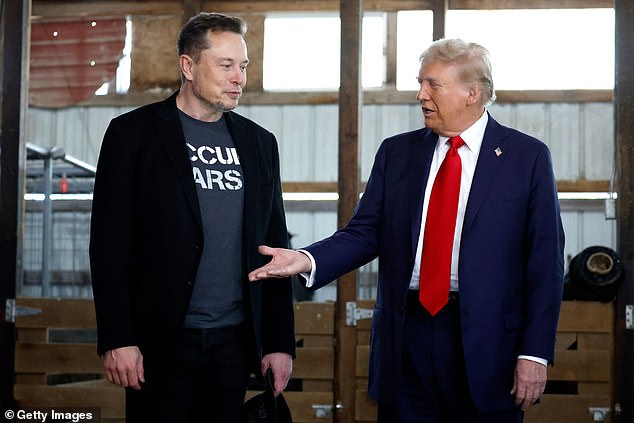

- PODCAST: Trump's 'Freedom Day' Tariffs, along with an unexpected push for the death penalty in the Luigi Mangioni case. Tune into Welcome to MAGAland here.

The Australian stock market experienced a significant drop of 6.4 percent during early trading, marking its poorest beginning to a session in the last five years since the onset of the COVID-19 pandemic.

Investors were preparing for a potential $115 billion drop on Monday. Donald Trump 'Tariffs spark concerns about a potential worldwide economic downturn, with initial losses totaling approximately $187 billion.'

The S&P/ASX200 index plummeted by 6.4 percent within the initial 10 minutes of trading, falling to 7,113.0 points.

This was even more disappointing than the futures market prediction on Monday morning. A decrease of 5.11 percent to 7,387.5 for today.

If this forecast comes true, over $115 billion could vanish from investment holdings in the Australian stock market.

Technology shares are experiencing losses as Life360 dropped 10.99 percent in early trading to $16.10, despite its value tripling over the past year.

In 2024, ZipCo, which was Australia’s top-performing stock, experienced a significant decline with its share price dropping by 12.45 percent to reach $1.12. This came alongside BHP, one of the major miners, experiencing a drop of 9.13 percent bringing its shares down to $33.46.

In another bad sign, the Australian dollar has also slipped below 60 US cents for the first time since the start of the pandemic in March 2020, stirring fears of higher inflation As imported goods become pricier.

The Chief Commercial Officer and Market Strategist at Moomoo, Michael McCarthy, stated that this indicates global investment sentiment is being jeopardized.

"The Australian dollar, at minimum, indicates that we are already in crisis mode," he said to Daily Mail Australia.

'Many individuals have been discussing purchasing dips — this strategy has proven quite beneficial for folks over the past several years; however, the Australian dollar strongly suggests that currently might not be the ideal moment to do so.'

The currency's performance is linked to global growth trends, as commodities represent Australia's largest exports.

The value of the Australian dollar has currently deteriorated more than it did following the collapse of America’s Lehman Brothers in September 2008. As a result, the Reserve Bank has had to intervene in the foreign exchange market to ensure that the currency remains over 60 US cents.

Mr. McCarthy stated that the introduction of new US tariffs, such as those set at 34 percent for China and 10 percent for Australia, has sparked concerns about a potential global economic downturn and a return to the economic conditions seen in the 1970s when both inflation and unemployment were elevated simultaneously.

'Tariffs are the issue here – there’s no doubt about it,' he stated.

The issue at hand is stagflation, and tariffs contribute to this problem from two angles: they raise prices, thereby increasing inflation, and simultaneously disrupt the global economy.

Therefore, a sluggish economy coupled with increasing costs represents a significant financial crisis for all parties involved. This explains why markets are adjusting their valuations so intensively, as the outlook for 2025 has shifted dramatically, especially following the implementation of new tariffs.

Mr. McCarthy stated that financial markets currently view the likelihood of a worldwide recession as being 50-50.

'There is a genuine risk involved: several global strategists currently assess the likelihood of us entering a worldwide economic downturn at over 50 percent,' he stated.

'If the global economy, particularly the US and China, are under pressure, then it's inevitable that the Australian economy will be under pressure.'

Technology shares are anticipated to perform poorly on Monday.

'Growth-exposed stocks are particularly vulnerable today so that means the previously glamorous tech stocks are likely to be under severe pressure,' Mr McCarthy said.

'Previously stylish and advanced tech stocks will lead the sell-off, however, sectors focused on growth – especially industries such as mining – are expected to face significant pressure too.'

On Friday, gold prices dropped from their peak at $US3,155, and it seems that no sector within the Australian stock market will remain unaffected today.

'It's extremely improbable that anyone will manage to get away,' he stated.

However, Coles and Woolworths defied the downward trend on Friday.

"He mentioned that both in Australia and the US, the only stocks that performed well were from reliable domestic companies such as supermarkets and home retail stores," he stated.

Billionaire Elon Musk is apparently so enraged by the Trump Administration's tariffs that he plans to step down from his role at DOGE, the Department of Government Efficiency, which aims to reduce US$1 trillion in governmental expenditures.

Read more

0 Komentar